Rachel’s note: Phil Anderson has studied economics and markets for over 25 years.

And his track record is so good – flawless, really – that we just have to pull back the curtain on how he’s forecast every market move using the 18.6-year real estate cycle, which the market has followed religiously for over 200 years.

Generally, this averages out as 14 years up and four years down.

What does Phil mean by a real estate cycle? It’s how the economy will move (and why) over time. Because property, the economy, and stock markets move through a repeating series of peaks and troughs – like clockwork.

This serves as a guide as to when to buy real estate and when to stay out of the market – because land values and corresponding credit lead the economy.

The good news is that once you understand the real estate cycle, you can forecast it. And if you can forecast correctly, you can make money, protect your capital, make informed business and investment decisions, and leave a legacy for your family.

In today’s essay, despite what you may hear and read from so-called experts in the press, Phil says the housing market is going to remain strong well into 2023… and beyond.

By Phil Anderson, editor, Cycles Trading With Phil Anderson

Ask any economist, and they’ll tell you house prices will fall when interest rates rise.

That’s wrong. Dead wrong. (I’ll prove it to you in a moment.)

But it doesn’t stop them from making those claims.

See below…

We haven’t seen absolute house price declines on an annual basis in most markets, but that could be coming over the next few months. – Forbes

This reasoning is simply not true.

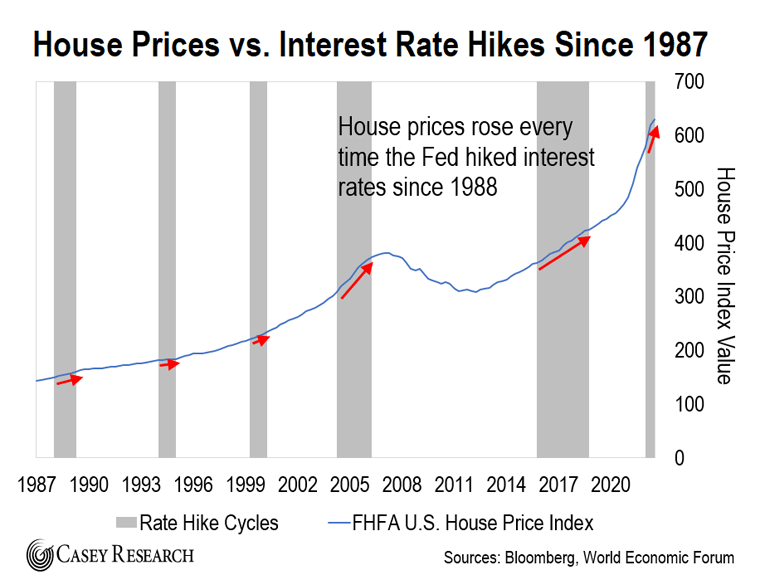

Check out the chart below. I plotted U.S. house prices overlaid with interest rate hiking cycles.

The chart goes back to 1987.

Every shaded area represents a hiking cycle – which in this chart is any period when the Fed raised rates at two or more consecutive meetings.

And during every hike cycle, house prices in the U.S., as measured by the FHFA U.S. House Price Index, went up…

Not down.

During the 2022 hike cycle (which isn’t over yet), house prices appreciated at the fastest rate in decades.

So much for the “higher interest rates will kill the housing market” narrative.

This Is History… Not Theory

Since 1955, the Fed has hiked interest rates 11 times. And every single time, U.S. house prices went up.

That’s history, not theory.

In fact, my research on long-term market cycles says that the housing market won’t peak for another few years.

Before that, don’t expect to see widespread price decreases.

At this stage in the cycle, I see at least two fundamental factors supporting house prices.

First, housing inventories are tight. At about 1.2 million, they are way off their 2008 highs of over 4 million units.

Second, homeowners are in no rush to sell their properties. No one wants to refinance at higher interest rates.

In other words, the housing market is going to remain strong well into 2023.

As I said above, we won’t see a turnaround until mid-decade. (And yes… I do know the exact year. But that’s reserved for members of my future project…)

This cycle still has room to run.

Regards,

Phil Anderson

Editor, Cycles Trading With Phil Anderson

P.S. At this stage in the cycle, we continue seeing news about ambitious real estate and infrastructure projects launched across the world.

Here’s another one: China is building the world’s largest wind farm and it could power 13m homes.