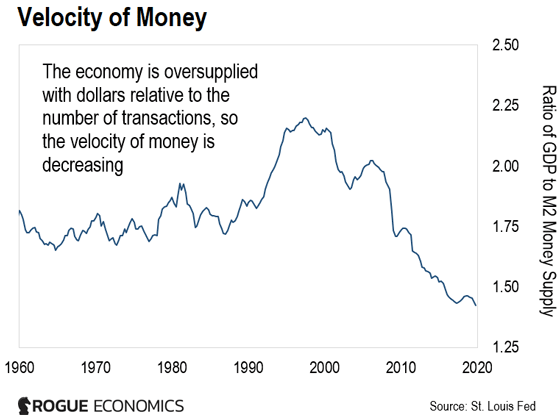

WEST PALM BEACH, FLORIDA – Yesterday, I published this chart of money velocity…

Money velocity measures the speed with which the dollar flies around the economy. It’s an important concept because it reveals inflation.

When people begin to lose faith in the purchasing power of a currency, they spend it faster and its velocity increases. When people hoard currency, velocity falls.

Think of velocity as the tension in a yacht’s sail. Velocity has been falling for 22 years because there hasn’t been any significant inflation.

But the moment inflation picks up, we’ll see velocity snap to attention like a sail suddenly catching the breeze.

For now, despite all the money-printing and deficit spending, there’s still no breeze…

Gargantuan Debt Load

For the government not to perish under the crushing weight of its gargantuan debt load, it must stimulate inflation.

What they’d like to do – and what I think they’re planning to do – is debase the dollar by 3% or 4% a year for the next 20 years.

Debasing the dollar by 4% a year over 20 years would reduce the value of the dollar by 55%, and therefore reduce their debt load by 55%.

Add in some economic growth. Problem solved.

Why 3% or 4%? It’s high enough to work off the debt load over time, and low enough that it doesn’t threaten the dollar’s role as global reserve currency or cause too much stress.

The Federal Reserve has long targeted a rate of inflation of 2%. So to push it up to 3% or 4% would seem to be politically acceptable, especially if it gets us out of deflation.

Of course, it’s absurd to think you can control something as volatile and unpredictable and complex as inflation… but I’m not trying to advise the feds. I’m simply trying to foresee how this is all going to play out the best I can…

Liquidity Trap

Either way, as the chart of money velocity above shows, they haven’t been able to stimulate the inflation they need for the plan to work.

It’s a psychological issue. Regardless of how much money they print, people keep hoarding dollars. Velocity keeps falling.

In my opinion, the only way out of this liquidity trap is for the feds to push the price of gold higher. A rising gold price would send the message that they’re going to let the dollar devalue.

It’s a message everyone would understand.

If they did this, velocity would “snap” to attention and I suspect they’d get the inflation they wanted (and maybe a lot more than they’d bargained for…).

This is the main reason Kate and I have converted all our savings to gold. We’re betting the feds eventually figure out they can break deflation – and stimulate the inflation they need – by simply making the gold price rise.

We want to “front run” that and then protect our savings from the inevitable long-term devaluation that follows (which we think will likely be more than 3% or 4% a year).

How long will it take for them to break deflation? I am mentally prepared to wait for five to 10 years.

Although now that a recession is here and they’re getting a bit desperate, I think it’ll happen much faster…

We’ll see…

– Tom Dyson

Like what you’re reading? Send your thoughts to [email protected].

FROM THE MAILBAG

One reader questions Tom’s decision to travel America… another asks for the Dyson kids’ input… while another worries about Tom as he begins writing another newsletter (on top of the Postcards)…

Reader comment: I think your thoughts regarding family relationships and how you found your life again by being on this traveling adventure with your wife and children is gold. Spiritual and emotional gold. It is beautiful and precious, and it was a powerful hit in the heart. You couldn’t have intuited this any better. As the times continue to be challenging, we will need these bonds of family relationships more than ever. Thank you for having written this so succinctly.

Reader comment: What happened to “shelter-in-place”? Does it not apply to you? The last I heard, the Badlands, Yellowstone, and all other national parks were closed. In California, there are no places to stay in state parks, or even regional ones. Motels are closed. In Santa Cruz, CA several teenagers got $1000 tickets each for traveling for about 30 miles to the beach and violating the “shelter-in-place” restrictions. So I say again, why don’t the rules apply to you?

Tom’s response: We don’t leave for another week. And we’re banking on the fact that most states will have already lifted shelter-in-place orders by then. They’re already lifting them in the Southeast, where we are. If not, we’ll react accordingly…

Reader comment: It would be most interesting to ask your children to compose a statement for publication regarding what their perspective is on family dynamics/relationships pre- and post-travel. You may be personally surprised by their response. For me, I feel your tale is not complete without this material being provided. I welcome a response.

Tom’s response: Okay!

Reader comment: Tom: I’ve been reading (most) of your Postcards From the Fringe, and I am amazed and fascinated by your story of divorce and around-the-world travel with your family that followed. As a divorced father, I struggled with the difficulties of trying to navigate work and being a father to my children every other weekend. I hated it. My children are now grown, but truly, I missed much of their childhood due to my misplaced priorities. Your story of cutting attachments and embarking on an around-the-world journey should serve as an inspiration to others. I hope you (or your wife) compile your thoughts into a book at some point. I would love to read your thoughts about your transformation.

Reader comment: I’ve only been a follower for about three months now. I enjoy your stories and financial insights, also. You are very family-oriented now, which I think is exceedingly excellent.

I wonder if your beginning a new newsletter is a wise choice. It will siphon off a lot of enjoyable time with your well-loved family. You will be compelled to deliver an excellent product to your paying clients, and provide tangible profits for them. You don’t want to become the person that you were before. That would be a terrible tragedy. My free advice is worth what you paid me. Your free advice is invaluable. Loving your Postcards.

Tom’s response: I’ve thought about this a lot. When my publisher first asked me to write a paid advisory, I turned her down. And then, I turned her down again. And again. I didn’t want to be on the hook for producing another new investment idea every month… which I knew I couldn’t do (and I’d be miserable trying to do).

But then, I noticed myself pleading with my parents, and my siblings, and Kate’s parents to buy gold and sell stock. I told them that a recession was coming, that the government was going to devalue the dollar…

And that’s when I realized… my ideas aren’t about finding the next great trade or a new stock recommendation. They’re about protecting ourselves from the severe devaluation of the dollar that’s coming, which will destroy our savings if we don’t do anything about it. I imagine my readers, for the most part, are just like my parents and Kate’s parents. And I realized I had something important to say…

And so I told my publisher that I’d write a premium product… but on one condition… that she didn’t promise potential subscribers that I’d deliver an ongoing stream of investment ideas and trading recommendations. So instead, I agreed to write a special report or “white paper” that shows people the practical steps to get their money out of the dollar and to safety… I’ve written the report now… I’m just tying up the loose ends. And next week, I can get back on the road and get back to writing what I love writing most – these Postcards.

And, as always, your messages are an integral part of these Postcards. Please keep writing us at [email protected].