As I wrote to you last week, Congress resembled a Wall Street trading desk in 2022.

In total, members of Congress bought nearly $187 million worth of stocks last year. That’s up 26% from $149 million worth of stocks purchased in the year prior.

Needless to say, it’s important to watch how your legislators are investing their own money. It offers key insights into which areas of the market are performing well, as many lawmakers have access to insider information we simply don’t.

So today, in the final installment of a three-part series about congressional trading, I’ll dive into two main sectors at the heart of Congress’ investments. I’ll also explore which companies the House and the Senate favor, and how following their money can help you grow your wealth.

Where Congress Members Invest Their Money

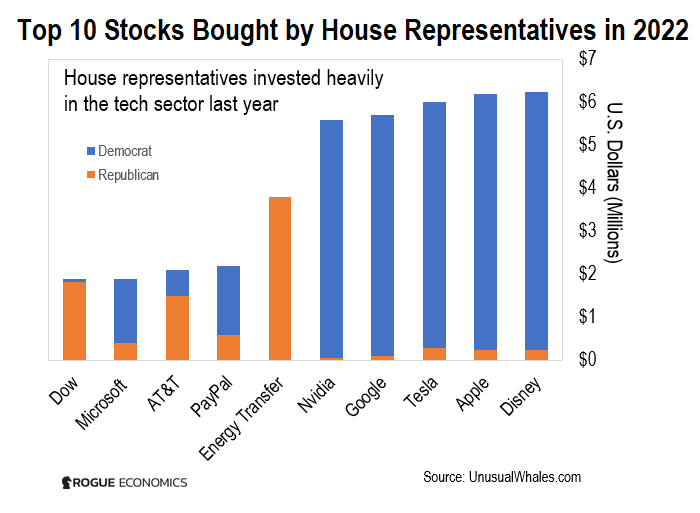

Last year, members of the House bought $41.7 million worth of their top 10 preferred stocks. The following chart highlights each of these 10 companies…

As you can see, House members overwhelmingly favored the technology sector. The top five companies are well-known names: Apple, Tesla, Alphabet (Google’s parent company), and Nvidia.

What’s more, Democrats did 78% of the buying, at $32.6 million. Their favorite stock was Disney, with $6 million worth of investments.

Apple came in second to Disney, equaling just under $6 million worth of investments.

Meanwhile, House Republicans bought $9.1 million of their top 10 stocks. They focused on a mix of sectors and targeted companies like Energy Transfer, Dow, AT&T, and PayPal.

Over at the Senate, it’s a similar story.

In 2022, members of the Senate bought $8.3 million worth of their 10 preferred stocks. And as you can see, the top 10 stocks were in the technology sector, followed by infrastructure.

Specifically, the top four companies were giants Microsoft, PayPal, Intel, and U.S. Steel.

While Democrats made up most of the investments in the House, Republicans were responsible for nearly 70% of the buying in the Senate last year…

The Upshot

Overall, congresspeople invested heavily in tech in 2022.

This is in stark contrast to 2021 when the top 10 preferred stocks were in the infrastructure sector.

Now, both senators and representatives also put their money into infrastructure… but to a lesser degree.

This is all very interesting given that both sectors didn’t perform well in 2022. The Technology Select Sector SPDR Fund ETF (XLK) declined 25% for the year, while the Global X U.S. Infrastructure Development ETF (PAVE) finished the year 3.4% lower.

Yet, members of Congress as a group braved the 2022 market selloff to buy shares of technology and infrastructure companies.

Now, congresspeople’s love for Big Tech investments is nothing new. Though, as I mentioned last week, D.C. politicians’ tech-stocks buying was down 29% from 2021.

Guess what wasn’t down compared to 2021?

Congress’ investing in infrastructure stocks.

Here’s why…

In 2021, the White House signed a $1.2 trillion infrastructure bill. The funds go toward updating highways, bridges, power grids, energy storage, and much more.

Granted, Congress still hasn’t greenlit many items that were already funded by the 2021 Infrastructure Act. But that’s going to happen soon. We’ll see bipartisan support to fix commuter corridors, highways, roads, and bridges early this year.

Lawmakers know that, and they are investing accordingly.

What This Means for Your Money

Congress members’ investment choices align directly with two of our main sectors and investing themes – Transformative Technology and Infrastructure.

Now, as I mentioned above, it’s true that these two sectors didn’t do great last year.

But it wasn’t just tech and infrastructure. 2022 was a universally horrible year to be in the markets.

The S&P 500 (a benchmark for U.S.-listed stocks including dividends) lost roughly 20%. Nasdaq fell an impressive 35%. Bonds were down 12%.

In fact, it was probably one of the worst years performance-wise for stocks and bonds going back to 1929. That means 2022 is right up there with the ugliest years of the Great Depression, the 2008 financial crisis, and the dot-com bust.

But infrastructure and technology – the sectors that congress members bought into the most in 2022 – could still prove to be winners in the later stages of the Fed’s pivot.

Let me explain…

I’ve been talking about the Federal Reserve’s pivot to neutral monetary policy since August. It involves three stages.

The first stage of the Fed pivot involves a reduction in the size of rate hikes. For instance, Stage 1 began on December 14, when the Fed increased rates by 50 basis points after four consecutive 75-basis point hikes.

And at the Federal Open Market Committee (FOMC) meeting earlier this month, the Fed raised interest rates by 25 basis points, confirming we are in Stage 1.

Stage 1 is a great time to invest in real assets like metals, energy, and, of course, infrastructure.

That’s because a reduction in the size of rate hikes should ease fears of a global economic slowdown. When that happens, more money will pour into infrastructure, benefitting industrial and real asset companies.

Plus, many infrastructure companies are relatively well-protected from higher rates. Over the past five years, they’ve taken advantage of low interest rates by locking in cheap debt for long periods.

So, if you want to invest in the infrastructure trend, consider the Global X U.S. Infrastructure Development ETF (PAVE).

What about technology?

The arrival of Stage 1 doesn’t mean we’re not going to see some more solid Transformative Tech shares rising. But most of that activity will happen during Stage 2, which involves a pause in rate hikes.

Unlike what Silicon Valley would have you believe, tech companies are capital-intensive. They rely on cheap capital for their growth plans and are very sensitive to changes in interest rates. That’s why they did so badly last year.

But this also means that when we finally get a pause in rate hikes, tech companies will go back to outperforming the market.

When that happens, we will make sure to update you.

For now, infrastructure is a safer bet. Even so, this still isn’t the time to dive head-first.

Instead, I recommend you invest smaller amounts over a longer period of time.

This is what we call “legging in,” or “dollar-cost averaging.”

None of us can time the market with 100% accuracy. And none of us can get every investment right.

This sort of approach can help protect your nest egg if one of your investments doesn’t work out.

Regards,

|

Nomi Prins

Editor, Inside Wall Street with Nomi Prins