By Nomi Prins, Editor, Inside Wall Street with Nomi Prins

The U.S. dollar is under threat.

All over the world, trust in the dollar as the currency for payments and reserves is slowly eroding.

That doesn’t mean the dollar’s going away as the world’s dominant currency anytime soon.

But it means you should pay attention to wars against the dollar today.

Our debt ceiling debates over at Capitol Hill only worsen the issue. After months of political posturing, the new agreement to raise the debt ceiling passed the House floor last night.

Next, it faces the Democratic-led Senate floor. Policymakers will have five days to vote before a possible default on Monday.

We have always said the deal will eventually pass both chambers… and that the debt ceiling will be raised. But the political drama has made the entire U.S. government’s political status look unstable and the dollar more unattractive.

So in a separate piece on Monday, I’ll explain why that’s the case… and how rising debt has a negative effect on our currency.

But first, let’s take a closer look at how trust in the U.S. dollar has crumbled recently, and how it relates to the Fed raising interest rates. I’ll also discuss why this has been a trend in motion for the past few years, and what it means for your money…

Trust in U.S. Currency, Banks, and Credit Is Eroding

In March of last year, the Fed began its series of quick interest rate hikes.

As we’ve written before, the interest rate increases hurt the value of Treasury bonds that U.S. banks held for liquidity purposes. That created massive paper losses.

But when a large number of depositors take their money out at the same time, these paper losses turn into real ones.

We saw that first with the collapses of Silicon Valley, Signature, and Silvergate Banks. Then, the major European bank Credit Suisse failed shortly afterwards. First Republic Bank was the next one to go belly up. And as we wrote to you recently, PacWest looks like it’s on the verge of collapse.

When depositors get really worried about the safety of their money, that can cause a domino effect in the banking sector.

Yet, rising interest rates didn’t just trigger volatility in the banking sector. They contributed to an eroding of trust in the dollar as a payment system globally.

Higher interest rates made borrowing U.S. dollars too expensive. That’s especially true for emerging market countries. It makes paying back their debts even more challenging.

As a result, collectives like Brazil, Russia, India, China, and South Africa (the BRICS) and other countries are increasingly trading with each other using non-dollar currencies.

President Lula of Brazil, the world’s 10th largest economy, announced his intent to reduce Brazil’s reliance on the dollar in foreign trade during his recent visit to China.

India developed a rupee payment system that enables trade settlements away from the dollar. Plus, Indian oil refiners are now using the UAE’s dirham to buy Russian oil, instead of using the U.S. dollar due to sanctions against Russian oil.

Argentina, on the other hand, just announced that it will officially start paying for Chinese imports in yuan rather than dollars. The country, which is struggling from high inflation, hopes that the currency deal will ease its diminishing dollar reserves. It also hopes this will lessen its dependence on the U.S. dollar.

All of these examples point to how countries are now accelerating efforts to turn away from the U.S. dollar. But there’s more to the story…

Foreign Governments Are Dumping U.S. Treasury Bonds

Because of U.S. bank failures and rising borrowing costs, policy leaders around the world are now afraid of further losses. Other countries are seeking a back-up plan to reduce their dependence on the dollar.

They can partially achieve this by decreasing their dollar-denominated holdings in U.S. Treasury bonds.

In fact, foreign treasuries and governments were dumping U.S. Treasuries throughout 2022. At the same time, the Fed was raising rates aggressively.

That is not coincidence. It is no conspiracy theory. There are no tinfoil hats here.

You can follow the money.

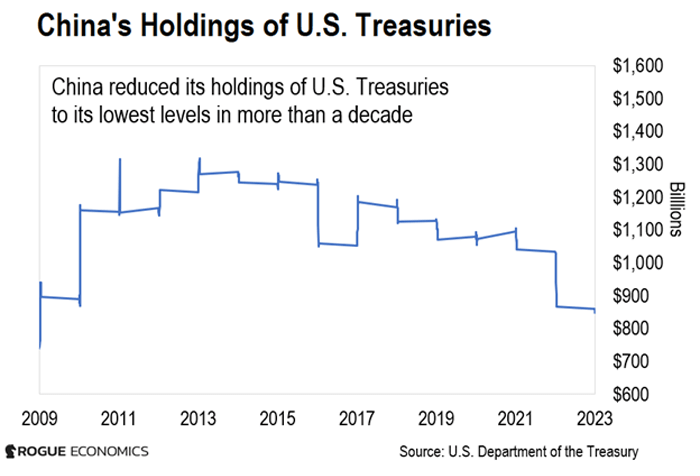

China, the world’s second largest economy and second greatest holder of U.S. Treasuries, cut its holding of Treasuries to its lowest levels following the Fed’s interest rate increases last year. You can see that in the chart below…

China sold nearly $154 billion in U.S. Treasuries between March 2022 and January 2023 alone.

But it’s not just China. Japan, another top holder of U.S. Treasuries, sold $125 billion during that period.

This trend isn’t limited to the financial crisis of the past year. It’s indicative of a wider, global movement to move away from the dollar…

Why Pushback Against the Dollar Has Gained Steam Globally

To get a good indicator of international sentiment about the dollar, let’s look at where the dollar stands in foreign reserves.

The dollar holds less of a premium position today than it did in 1999 when the euro was introduced. Back then, central banks held 70% of their foreign reserves in U.S. dollars.

Now, global central banks hold about 58% of their foreign reserves in U.S. dollars.

In comparison, they hold a mix of the euro at 20%, British pound at 4.9%, Japanese yen at 5.5%, and Chinese yuan at 2.6%.

What that means is that the dollar is still king. It’s the dominant reserve currency by a factor of nearly three times the next largest currency, the euro.

But as we explained above, there is a trend in motion to undermine the dollar. Here’s why…

First, other governments want to control their own economic destinies. They’ve seen the financial turmoil that comes with a stronger dollar. That’s because a strong dollar makes their own currencies weaker.

And it makes it harder for them to repay dollar-denominated debt and to trade for goods and raw materials.

For instance, countries like Egypt, Pakistan, and Ghana recently asked for bailouts by the International Monetary Fund (IMF). This is due to financial stress caused by a stronger dollar compared to their own currency.

Because they borrowed heavily in U.S. dollars, paying it back meant a squeeze on what they could spend domestically. For them, moving away from the dollar is a matter of economic survival.

Second, other governments increasingly don’t trust the U.S. on a financial and geopolitical level. Political tools like sanctions and embargos were the first to create distrust.

Then, continued bank failures, high interest rates, and economic uncertainty make business with the U.S. a financial liability.

The economic sanctions placed on Russia in response to its war in Ukraine serve as a reminder to global leaders risking political friction with the U.S.

That’s why major trading partners like China are taking action. This year, China stuck a deal with Brazil to pay for trade and financial transactions in their own currencies instead of using dollars.

While moves like these are noteworthy, they are still small and gradual – like a death by a thousand cuts. To be clear, king dollar is not losing its status overnight.

But understanding that the dollar’s position is not what it once was is important.

So, while global investors and institutions still see the dollar as the dominant currency, there are ways to diversify your portfolio, your money, and your investment outlook as this trend unfolds.

One of the main reasons, as we discussed above, for less confidence in the dollar is the instability of the U.S. banking system.

To protect yourself from further uncertainty, avoid investing in banks that are at risk of failure. Consider our checklist regarding your deposits and bank choices right here if you haven’t yet.

Regards,

|

Nomi Prins

Editor, Inside Wall Street with Nomi Prins

P.S. As banks fail and countries around the world begin to turn away from the dollar, I’ve found evidence that a small group of powerful people are preparing to overhaul our monetary system as we know it.

It’s a plan that the Federal Reserve, the White House, and the financial elite are set to enact as more uncertainty unfolds.

Pulling your cash out of the bank won’t be possible. But I’ve found one asset that can help you become your own banker – and escape the clutches of this power grab. To learn more, watch my urgent video presentation right here.